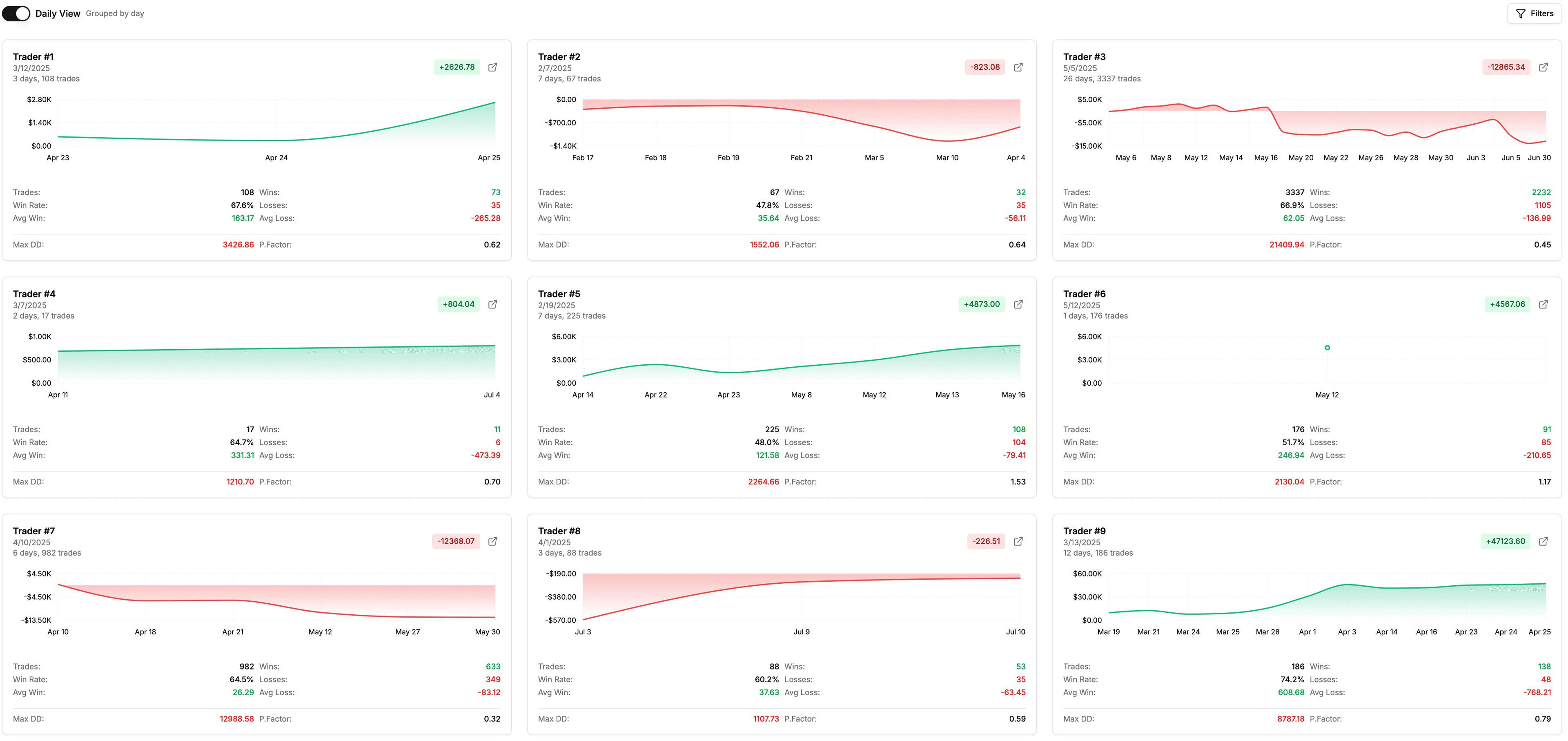

Know which traders make money in real-time

See exactly what your best traders do differently across any broker. Track every position, spot patterns that work, and turn insights into bigger profits - all in real-time.

Everything you need to scale your trading firm

The complete toolkit that turns trading data into actionable insights

Monitor all accounts in one place

No more switching between 12 different platforms. See every trader, every account, every position on one screen.

Spot your star performers instantly

Know who's crushing it and who needs help. Identify winning patterns and replicate them across your team.

Get alerts before losses pile up

Instant notifications when traders hit risk limits or unusual patterns emerge. Stop problems before they drain your capital.

Prevent blowups before they happen

Advanced early warning system for position sizes, drawdowns, and correlated risks that could wipe out accounts.

Reports that actually save you time

One-click regulatory reports and investor updates. What used to take days now takes minutes.

Works with any broker

Intelligent data imports from 50+ brokers. Track traders across multiple platforms with automatic synchronization - no matter where they trade.

Built for different types of trading firms

Whatever you trade, however you trade it

Hedge Funds & Asset Managers

Transparent reporting for investors. Attribution analysis that actually makes sense. Performance tracking that builds trust.

Proprietary Trading Firms

Scale from 10 to 1,000 traders without losing control. Spot winning strategies and eliminate losing ones.

Family Offices

Sophisticated analytics for complex strategies. The transparency and control that family wealth deserves.

Institutional Trading Desks

Enterprise-grade platform that handles your volume and complexity. Built for the biggest players.

Ready to get started?

See why 500+ trading firms trust Deltalytix. Schedule a consultation today.

Custom onboarding • Setup in 5 minutes • No long-term contracts